The difference between a successful flip and a stalled project often comes down to one thing: an accurate rehab budget. In the competitive world of real estate investing, relying on guesswork can wipe out your profit margin. Savvy investors know that banks are too slow for distressed assets, and that a successful hard money loan starts with a rock solid, verifiable Scope of Work (SOW). Before you submit your next deal, stop using ballpark estimates. Instead, use a tactical, pen-and-paper methodology that systematically uncovers the true cost of renovation, giving your lender—and your bottom line—total confidence.

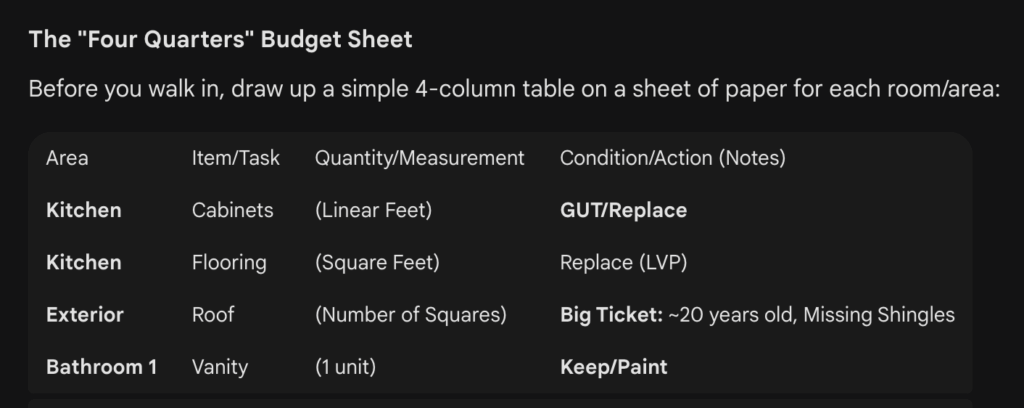

The “Four Quarters” Budget: Tactical Inspection for Speed

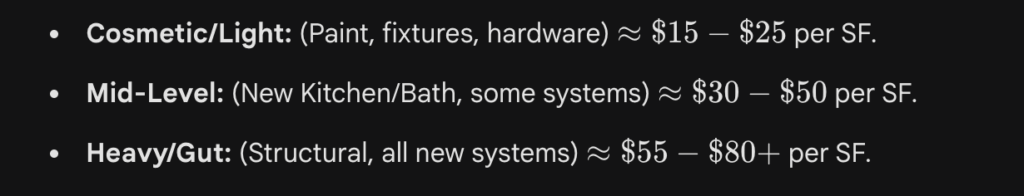

The most commonbudget pitfall is missing a major system replacement. To combat this, structure your property analysis into a simple, room-by-room checklist, separating the “Unseen Cost Drivers” from the “Aesthetic & Value-Add.” Start with the big-ticket items: Roof, HVAC, Foundation, Windows and Electrical/Plumbing. Note the age and condition of each system. Is the furnace 20 years old? Is the electrical panel a fire hazard fuse box? These are automatic, non-negotiable budget lines. Next, move to your aesthetic upgrades—kitchen, baths, flooring—and use a simple $/\text{SF}$ calculation to quantify materials needed. By documenting every item and its required action on a detailed sheet, you create a defensible SOW that minimizes surprises when the walls are opened.

The Power of the Contingency Buffer

Even the most meticulous SOW must account for the unknown. This is why a non negotiable Contingency Buffer is a strategic necessity, not just a line item. Based on the level of rehab, you should immediately apply a percentage to your total construction costs—typically $10\%$ for cosmetic flips up to $20\%-25\%$ for heavy, down-to the-studs renovations. This buffer is your insurance against the hidden water damage behind the drywall or the unexpected sewer lateral issue. Hard money lenders look for this disciplined approach, as it demonstrates an understanding of risk management and provides a cushion to keep your project on schedule and on budget, ensuring a timely exit.

Beyond the Materials: Factoring in All Financial Buckets

A truly complete budget for a flip includes more than just the rehab. You must account for all five financial buckets: Acquisition Cost, Rehab Cost, Holding/Carrying Costs, and Selling Costs. Your Holding Costs—taxes, insurance, utilities, and loan interest—

will accumulate over the project’s timeline, typically 6-12 months. Your Selling Costs, including realtorcommissions and closing fees, will reduce your final profit. When all these numbers are calculated and the necessary contingency is applied, you arrive at the true capital requirement for the deal, which forms the basis of your After Repair Value (ARV) and your loan request. This comprehensive financial model is the language of successful investors.

Jump Capital Hard Money Lending is Ready to Close Your Year-End Deal Now

Don’t let a tight closing calendar or complex rehab budget keep you from maximizing your year-end profits. At Jump Capital Hard Money Lending, we focus on the integrity of your deal, not bureaucratic timelines. Our asset-based lending model is designed to move at the speed of the investor, providing the capital and renovation funds you need with fast approvals and efficient draw schedules. If you have your tactical SOW and comprehensive budget in hand, Jump Capital Hard Money Lending is ready to close your year-end deal now. Contact us today to secure your funding and finish the year strong.