or the Fix-and-Flip Investor: It’s All About the Spread For house flippers, property evaluation is a race against the clock and a battle for margin. The most critical metric here is the After Repair Value (ARV)—a precise estimate of what the property will sell for once fully renovated. Flippers cannot rely on current market value; they must analyze “comps” of recently sold, renovated homes in the immediate vicinity to forecast the future price. Seasoned flippers often stick to the 70% Rule, aiming to spend no more than 70% of the ARV minus repair costs. Beyond the purchase price, the evaluation must aggressively account for “holding costs”—loan interest, insurance, utilities, and taxes—because in flipping, time literally equals money. If the numbers don’t show a significant buffer for unexpected rehab surprises, the deal is a pass.

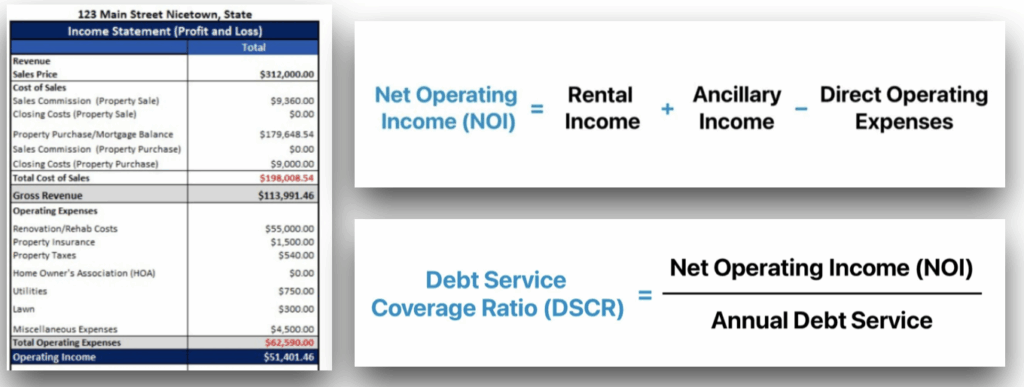

For the Buy-and-Hold Investor: Cash Flow is King When evaluating a rental property, the focus shifts from a one-time profit to long-term sustainability. The primary goal is Cash Flow—the net income remaining after all expenses (mortgage, taxes, insurance, and maintenance) are paid. Investors in this space lean heavily on the Debt Service Coverage Ratio (DSCR), a metric that lenders also use to ensure the property’s rental income can comfortably cover the debt. While appreciation is a nice bonus, smart buy-and-hold investors analyze the Cash-on-Cash Return and Cap Rate to determine how hard their capital is working today. They are looking for stability, low vacancy rates, and neighborhoods with strong rental demand to ensure the asset pays for itself indefinitely.

For the Commercial Investor: Valuing the Income Stream Commercial real estate evaluation is less about the building itself and more about the business inside it. Unlike residential homes, commercial properties are valued primarily on their Net Operating Income (NOI). Investors must perform deep due diligence on lease terms, tenant creditworthiness, and economic drivers like local job growth and traffic counts. The risk profile is different here; a vacant commercial building can take months or years to fill, so the evaluation focuses heavily on the stability of the current tenants and the strength of the local economy.

It is a game of pure numbers, where the Capitalization Rate (Cap Rate) determines the purchase price, and the physical condition of the asset is just one variable in a complex financial equation.

At Jump Capital Private Lending, we understand that a fix-and-flip loan requires a completely different mindset than a commercial loan. We use our experience across all these asset classes to do more than just write checks; we act as a second set of eyes on your deal. When you bring us a potential investment, we look at the same metrics you do—ARV, DSCR, and NOI—to help validate your strategy and ensure the numbers make sense. By tailoring our financing solutions to match the specific “math” of your project, we help you avoid pitfalls and capitalize on opportunities with confidence. We are here to ensure that every move you make is a move forward.